how to calculate pre tax benefits

In the new tax regime you forgo most exemptions and deductions for instance LTC HRA standard deduction deductions under Sections 80C 80D 80E 80G and so on. 401K and other retirement plans.

Pin On Affordable Health Insurance

Individuals will have to pay income taxes on withdrawals though you can split the tax payment across up to 3 years.

. Health insurance deductions can either taken be pre-tax or post-tax. Most seniors who live entirely on Social Security retirement benefits and public pension income are eligible for a full exemption on that income. If you return the cash to your IRA within 3 years you will not owe the tax payment.

You will pay of Missouri state taxes on your pre-tax income of. The employer makes the payroll deduction according to the deduction category. Depending on the employer the plan may include dental coverage.

A cafeteria plan including an FSA provides participants an opportunity to receive qualified benefits on a pre-tax basis. Is the method outlined in Taxation Ruling MT 2024 appropriate for determining whether a vehicle other than a dual or crew cab is designed for the principal purpose of carrying passengers and thereby ineligible for the work-related use exemption available under subsection 82 of the. Your taxable income is taxed at the relevant tax slab rate and cess is added to give you your total tax payment.

If an employee chooses to. The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus. However income from retirement accounts such as an IRA or 401k are.

Post-tax A pre-tax health insurance. It is a written plan that allows your employees to choose between receiving cash or taxable benefits instead of certain qualified benefits for which the law provides an exclusion from wages. Calculate income tax for the new regime.

Taxation Determination TD 9419 Fringe benefits tax. An employer health plan provides medical insurance to employees and often their dependents and spouses as well.

How To Build Passive Income For Financial Independence Passive Income Best Way To Invest Financial

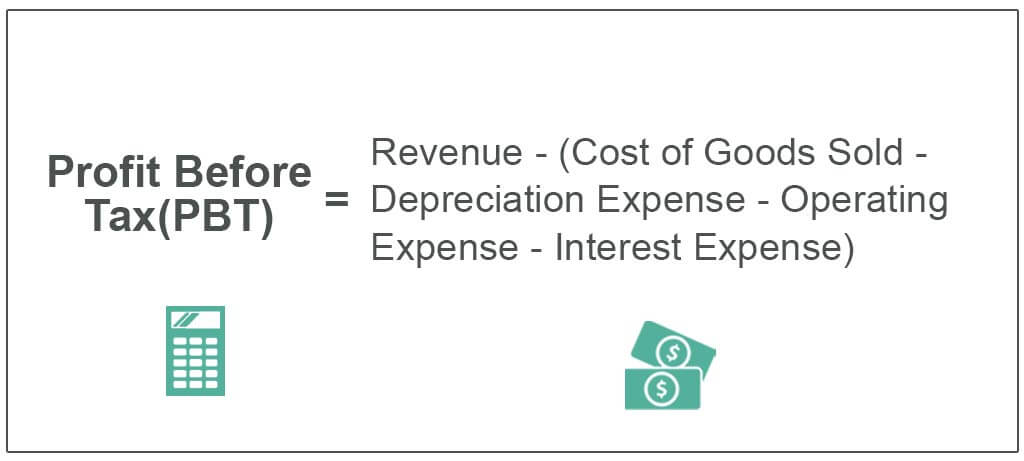

Profit Before Tax Formula Examples How To Calculate Pbt

A Visual Guide To Employee Ownership Employee Stock Ownership Plan Business Leadership Journey Mapping

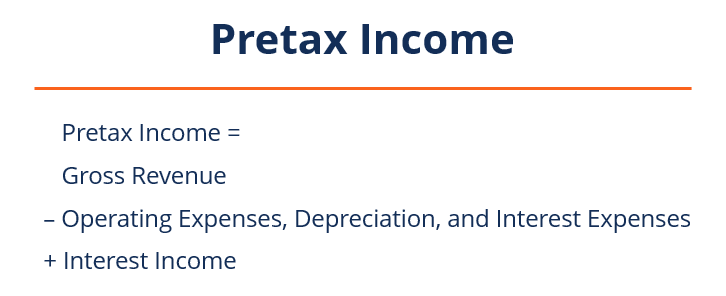

Pretax Income Definition Formula And Example Significance

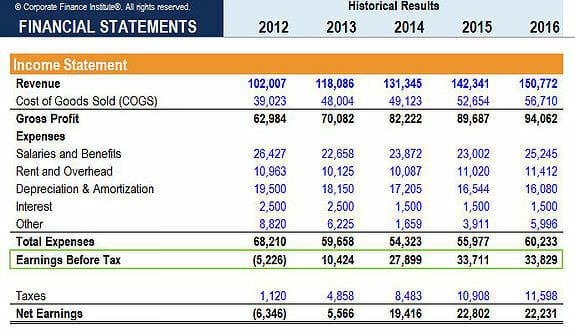

Earnings Before Tax Ebt What This Accounting Figure Really Means

Budget For Family Of Three Retiring Early Off 5 Million Early Retirement Retirement Financial Independence Retire Early

Download Employee Turnover Cost Calculator Excel Template Exceldatapro Employee Turnover Payroll Template Turnovers

7 Money Smart Graduation Gift Ideas For College Graduates Lucky Mojito Smart Money Finance Money Saving Tips

Pin By Raf On Healing State Tax All News Fiscal

Mortgage Comparison Spreadsheet Mortgage Comparison Mortgage Loans Mortgage

Network Marketing Tax Benefits Google Search Direct Sales Business Business Tax Tax Deductions

Benefits Of Pre Purchase Property Valuation Property Valuation Buying Property Property

Overtime Pay Laws Every Business Owner Needs To Know Business Entrepreneurship Business Owner Business Basics

More Top Irs Audit Triggers To Avoid Infographic Irs Audit

There Are Many Reasons To Stop Renting And Start Owning Being A Landlord Home Ownership Rent

How Is Tax Collected On Taxable State Benefits Low Incomes Tax Reform Group